QANTARA AFRICAN SOVEREIGN BONDS Newsletter - January 2026

- Agence MC WEB

- 6 hours ago

- 12 min read

Despite an environment marked by rising USD yields, African Eurobonds have shown a degree of resilience: the depreciation of the USD and the strong appetite for emerging‑market assets continueto support the asset class. The average level of credit spreads remains historically low despite significant dispersion among issuers. The most stressed names in the universe have rallied significantly. Favorable conditions in the primary market are creating opportunities for several issuers.

The asset class now has only one name trading in distressed territory : Senegal. Movements in Senegal’s bonds (USD spreads around 1,300 bps) continue to diverge from the broader market recovery. Concerns about the country’s ability to avoid default are still weighing on its securities. Although the authorities continue to access financing on the regional market, funding costs have risen sharply (1‑year yields now above 7%), and investors are favoring the short end of the curve, with weak demand for longer maturities. The new IMF mission chief has met with the authorities, but negotiations for a new support program remain uncertain. There is still no clear consensus within the government on whether a debt restructuring is necessary, and the policy options considered to restore fiscal sustainability appear difficult to implement. Market prices already reflect a restructuring scenario. In our view, certain bonds—especially on the long end of the curve—are beginning to offer tactical opportunities

At the same time, Gabon has benefited from a significant tightening of its sovereign spreads (–280 bps over the month, to around 780 bps), following progress toward a potential IMF agreement. The government, appointed at the beginning of the month, is reportedly ready to implement an ‘economic growth program’, while the IMF has announced an official visit for early February. Such support is viewed as essential to cover the country’s financing needs—estimated at more than 20% of GDP this year—given its lack of access to international markets and the limited prospects for regional financing.

The prospect of a technical and financial arrangement is improving the credit outlook not only for Gabon but also for the broader CEMAC region, whose leaders held an emergency meeting on January 22nd amid looming external debt maturities as early as Q1 2026 and declining foreign-exchange reserves, now estimated at around USD 11.4bn (equivalent to 4.25 months of imports). Within the region, Congo and Cameroon have also seen a reduction in their risk premia. Cameroon, in particular, successfully raised USD 750mn via a five‑year privately placed Eurobond combined with a currency swap to maintain EUR exposure. The success of the transaction helps reduce short‑term funding risks.

Mozambique has also benefited from a substantial reduction in its risk premium (–49 bps) following the announcement of the official restart of TotalEnergies’ LNG project, which aims to start exports in 2029. The country faces its first Eurobond maturities as early as 2028, but the IMF program currently under negotiation could help strengthen the sovereign’s financial outlook. This would complement the new partnership framework agreed with the World Bank for the 2026–31 period, with total commitments potentially reaching USD 2.5bn. At this stage, however, the potential for further tightening remains relatively limited, as the government is facing significant liquidity pressures and has not ruled out a short‑term restructuring of its external debt.

Ethiopia has encountered a new setback in the restructuring of its Eurobond: the restructuring agreement reached in early January with a group of bondholders was rejected by the official creditors’ committee. The committee considers that the terms do not comply with the comparability‑of‑treatment principle, under which the debtor country commits to offering equivalent terms to all creditors. The two parties had agreed on conditions including a new USD 850mn bond

(representing a 15% haircut relative to the nominal value of the defaulted bond) maturing in 2029, with amortizations in three installments starting in 2026; the settlement of interest accrued and capitalized since the default; and a Value Recovery Instrument (VRI) linked to the country’s export performance. The VRI was designed to bridge divergent views regarding the IMF’s export projections, which private creditors deemed overly conservative. These terms implied a recovery value in the 100– 120% range. New terms will now have to be negotiated. Meanwhile, the country continues to pursue its reform agenda. The completion of the IMF’s fourth program review highlighted better‑than‑expected macroeconomic results, including an increase in foreign‑exchange reserves. The next (fifth) review is scheduled for April.

Zambia also benefited from the IMF’s approval of the sixth and final review of its program, which has supported the country since August 2022 and which the government has chosen not to extend, despite the program’s technical assistance having served as an important anchor for sovereign credit. The authorities are nevertheless considering the design of a new program to consolidate recent progress and maintain fiscal discipline. Fiscal discipline may come under slight pressure, as the country enters an election period, with presidential elections scheduled for August. In addition, the IMF’s latest reserve projections appear to be lower than previous estimates, creating greater uncertainty regarding the potential activation of the adjustment clause on the Zambia 0.5% 31/12/2053 bond. If triggered,

the clause would shorten the maturity and increase the coupon. Meanwhile, higher copper prices are expected to support reserve accumulation by year‑end.

Some countries continue to benefit from the surge in commodity prices. Ghana’s fundamentals, in particular, continue to improve, supported by both favorable economic conditions and ongoing reforms. The government has cleared nearly USD 1.5bn in arrears and has announced its first infrastructure bond issuance in the coming months—two tranches totaling GHS 10bn (approximately USD 935mn). This operation is part of a broader strategy to gradually reopen the local market. The country’s return to market access is expected to materialize as Ghana exits its IMF program in May.

The easing of domestic financial conditions should allow the sovereign to regain greater financial flexibility. This trend is likely to continue in a context of rapid disinflation, strengthening economic activity, and a significant improvement in fiscal and external balances: by end‑2025, the primary surplus is projected at 1.9% of GDP and the overall deficit at only –1.4% of GDP. The current account shows a surplus of 8.1% of GDP, with foreign‑exchange reserves approaching USD 14bn. We remain overweight on the name.

Rating updates

The recent improvement in Kenya’s fundamentals has resulted in an upgrade by Moody’s (from Caa1 to B3). External liquidity has strengthened, and the continued decline in inflation and in central bank’s nominal rates is enhancing the government’s ability to finance its sizeable budget needs on the local market, thereby reducing its dependence on external funding. The planned privatization of Kenya Pipeline Company (KPC)—a 65% divestment by the state—scheduled to close on February 19, is expected to attract some external financing flows. However, the lack of program with the IMF and the World Bank in recent months continues to limit the sovereign’s financial flexibility. Kenya’s risk profile remains constrained by low debt sustainability and insufficient progress in fiscal consolidation.

Benin (whose spreads tightened by 29 bps over the month) saw its outlook upgraded from Stable to Positive by Fitch (rating B+). The sovereign benefits from strong economic growth prospects and a firm commitment by the authorities to prudent fiscal management, which supports a medium‑term decline in the public‑debt‑to‑GDP trajectory. Continued investor confidence—reinforced by the legislative elections that secured an overwhelming majority for the ruling coalition—enabled the sovereign to achieve a successful return to the primary market.

Afreximbank has officially terminated its relationship with Fitch, arguing that the agency no longer provides an adequate understanding of its operations. Fitch had downgraded the bank’s rating from BBB– to BB+ after questioning its preferred‑creditor status in the context of the Ghana debt‑restructuring agreement. The preferred‑creditor status is a critical issue for the financing of African economies, given the increasingly important role played by African development banks in supporting the continent’s funding needs.

AFC for its part, received its first rating from S&P: an ‘A’ with a Positive outlook. The rating reflects a solid track record in asset quality, very strong liquidity coverage, and significant shareholder support, despite the institution’s highly concentrated shareholder base.

Primary market

Current financial conditions and the renewed positive flows into emerging‑market assets are creating a supportive backdrop for primary market. January was particularly dynamic, with a total issuance volume of USD 3.3 billion.

In addition to Cameroon - mentioned earlier - which issued USD 750 million in 5‑year bonds at a coupon of 10.125%, the month saw the debut transaction from Sonangol, Angola’s state‑owned oil company. Sonangol issued USD 750 million in 5‑year notes. The deal includes a leverage‑restriction covenant preventing the company from raising additional debt if the issuer’s minimum liquidity falls below USD 250 million, if the guarantor’s net‑debt‑to‑EBITDA ratio exceeds 2.5x, or if the EBITDA‑to‑debt‑service ratio drops below 1.3x. The bond also features a call option, allowing early redemption from January 2028 at 105%. Separately, the company secured a USD 1.75 billion syndicated facility arranged by Afreximbank. The African Development Bank (AfDB) conducted several smaller‑sized transactions and issued a benchmark USD 1 billion 10‑year bond (AfDB 4.125% 22/01/2036), which attracted over USD 6 billion in demand.

Finally, Benin issued its first USD‑denominated sukuk—a 7‑year, USD 500 million deal—and reopened its Benin 7.96% 13/02/2038 bond for an additional USD 350 million. The combined operation generated more than USD 7 billion in investor demand.

Over the coming weeks, additional sovereign and quasi‑sovereign issuances are expected. Angola is expected to raise approximately USD 1.7 billion on international capital markets in 2026. According to the government’s 2026 funding plan, the country also aims to secure around USD 1.4 billion in commercial financing—including “debt‑for‑health” swap operations—and USD 500 million from the World Bank through a Development Policy Operation (DPO). The government recently extended its credit facility with JP Morgan for an additional three years, while reducing the collateral requirement by USD 200 million and securing a lower interest rate of 8%.

The Democratic Republic of Congo (DRC) has also announced plans to raise USD 750 million in April, taking advantage of what it considers a favorable market environment, supported by surging gold and copper prices—two of the country’s key export commodities. Proceeds will be allocated to infrastructure development projects.

Rates & Inflation

The ongoing disinflation trend across the continent has led to several interest rate cuts.

Mozambique’s central bank extended its longest easing cycle in over two years, lowering its policy rate by 25 bps to 9.25%. This brings the cumulative reduction since the start of the cycle to 800 bps. As expected, the Bank of Ghana proceeded with another rate cut, reducing its policy rate by 250 bps to 15.5%. The MPC’s decision is underpinned by the continued moderation in inflation: headline CPI rose by 5.4% year‑on‑year in December, down from 6.3% the previous month, and within the central bank’s 6–8% target range. Average inflation for 2025 stands at 14.6%, compared with 22.9% last year.

The nominal policy rate has been lowered four times since July 2025, for a cumulative 1,250 bps decline. The strengthening of the currency—appreciating nearly 29% in 2025—has also contributed to the disinflation process.

Finally, Angola’s central bank implemented its largest interest rate cut in almost three years, reducing the policy rate from 18.5% to 17.5%. This marks the third consecutive reduction, following cuts in November and September of last year. Annual inflation slowed to 15.7% last month, from 16.6% in November, reaching its lowest level in more than two years, while the AOA remained broadly stable against the USD. The central bank expects inflation to fall further to around 13.5% by year‑end.

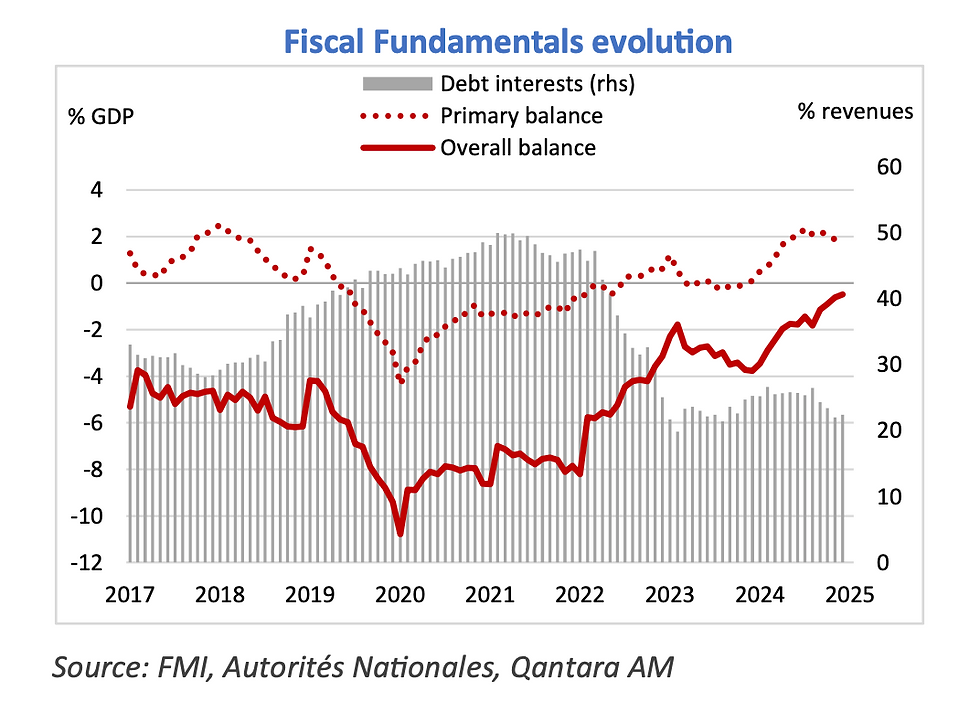

The combination of successive shocks from the pandemic, tighter global financial conditions, and heightened geopolitical tensions exacerbated Ghana’s structural imbalances, ultimately rendering its debt unsustainable by the end of 2022. Three years after entering default, the authorities have now nearly completed the restructuring of public debt. A strong commitment by policymakers to implement macroeconomic adjustment measures—combined with a supportive external environment—has enabled a significant improvement in the country’s fundamentals. Ghana therefore enters 2026 with a markedly improved outlook and upward‑tilting prospects.

Public finances at the end of 2025 significantly outperformed expectations. After a sharp fiscal slippage in 2024 in the context of the elections, the latest data point to a substantial improvement in the deficit: as of end-November 2025, it stood at –1.4% of GDP, more than three times lower than the previous year. The primary balance reached a surplus of 2.5% of GDP, comfortably exceeding the IMF target of 1.5% of GDP.

This surplus is mainly the result of public investment spending cuts that were deeper than anticipated, while revenues underperformed expectations—particularly due to the strong appreciation of the GHS, which reduced oil-related fiscal receipts. Continued reform efforts (VAT measures, digitalization initiatives, and the ongoing revision of the mining code), together with elevated gold prices, should help maintain a primary surplus this year.

Against this backdrop of fiscal consolidation, Ghana’s public debt continued to decline, signaling effective policy execution. According to government figures (excluding guarantees), public debt had fallen by more than 10 percentage points of GDP between June 2024 and November 2025. This decline reflects not only strong GDP growth—around 6% in 2025—but also a reduction in the nominal stock of

debt. The authorities’ objective of bringing public debt below 55% of GDP by 2028 thus appears comfortably within reach.

The combination of lower debt levels and shrinking fiscal deficits reduces the country’s financing needs—estimated at around 11% of GDP this year—and supports a continued improvement in debt-sustainability indicators. Interest payments still absorb a significant share of government revenues, but this ratio is on a downward trend (estimated at about 25% as of end-November 2025).

Ghana’s debt‑servicing capacity has also improved significantly, driven in large part by the appreciation of the GHS—nearly +30% against the USD in 2025—while roughly 50% of total public debt is denominated in foreign currency. The strengthening of the currency has been supported by a marked improvement in the external position: balance‑of‑payments inflows increased substantially over recent months and recorded a positive overall balance for 2025, buoyed in particular by gold export revenues (representing 70% of total exports), with international gold prices rising by nearly 65% over the year.

The value of gold exports doubled in 2025, contributing to a turnaround in the current‑account balance, which reached a surplus of more than 8% of GDP at end‑2025—after decades of persistent deficit.

These inflows enabled a rebuilding of foreign‑exchange reserves, which now cover 5.7 months of imports (USD 13.8 billion), up from 4.1 months a year earlier. The Bank of Ghana’s national gold‑purchase program also supported reserve accumulation: by centralizing gold purchases, the program ensured that a greater share of export proceeds was repatriated through official channels. Should the program continue to operate efficiently and international gold prices remain favorable, FX reserves are expected to remain robust in 2026. Despite higher external principal repayments, both FDI and portfolio inflows are likely to strengthen. Improved macroeconomic stability—reflected in a sharp decline in inflation (from over 54% at end‑2022 to below 6% at end‑2025), strong economic growth, and monetary easing—should help ease financing conditions and support the reopening of the domestic bond market. Under the IMF program, new non‑concessional external borrowing is capped at a net present value of USD 50 million in 2025 and USD 70 million in 2026 (until the program’s conclusion). As a result, the government is expected to

meet around 80% of its financing needs through domestic issuance, open to foreign investors. The anticipated reopening of the domestic market in Q2 should improve balance‑of‑payments financing and enhance the government’s overall funding capacity. The authorities have also announced an upcoming infrastructure‑bond issuance with maturities of up to 15 years. The resumption of medium‑ and long‑term bond issuance will help extend the maturity profile of the domestic debt stock, reduce rollover risks, and alleviate short‑term refinancing pressures. The improvement in Ghana’s credit‑risk profile has been reflected in recent upgrades by major rating agencies: Moody’s (Caa1, next review scheduled for early April), S&P (B‑, next review expected at end‑March), and Fitch (B‑).

Disclaimer

QANTARA ASSET MANAGEMENT – QAM

Registered in Paris RCS number 912 686 672

Headquarters: 44 Bis rue Pasquier 75008 Paris, France

Approved by the autorité des Marchés Financiers on 04/01/2023 as an asset management company under the number GP-20230002 This promotional document issued by QANTARA ASSET MANAGEMENT ("QAM") cannot be considered as a solicitation or an offer, legal or tax advice. It does not constitute a

personalized recommendation or an investment advice. Before making any investment decision, it is up to the investor to evaluate the risks and to make sure that this decision

corresponds to his objectives, his experience and his financial situation.

The investor's attention is drawn to the fact that the information concerning the products contained in this document is not a substitute for the completeness of the

information contained in the legal documentation of the UCITS FUND which was given to you and/or which is available free of charge on request from QAM or on the website

Prior to any investment, it is the investor's responsibility to pay particular attention to the risk factors and to make his own analysis, taking into account the need to diversify his

investments. All investors are invited to obtain information on this subject from their usual advisors (legal, tax, financial and/or accounting) before making any investment.

The information and opinions contained herein are for informational purposes only. It has been compiled from sources that QAM believes to be reliable, and QAM does not

guarantee its accuracy, reliability, timeliness or completeness. Past performance is not a guide to the future performance of the mutual funds and/or financial instruments

and/or the financial strategy presented. The performance data do not take into account any commissions contracted at the time of subscription or redemption in a financial

instrument. No assurance can be given that the products presented will achieve their objectives. Investing in financial instruments involves risk and the investor may not get

back the full amount invested. When a financial instrument is denominated in a currency other than your own, the exchange rate may affect the amount of your investment.

The tax treatment depends on the individual situation of each client. It is therefore strongly recommended that you find out in advance whether the investment is suitable for

your own objectives and legal and tax considerations.

It is your responsibility to ensure that the regulations applicable to you, depending on your status and country of residence, do not prohibit you from purchasing the products

or services described in this document. Access to products and services may be subject to restrictions for certain persons or countries. For more information, please contact

your usual contact person. Any complaint may be addressed free of charge to QAM's customer service department at the following address: service.clients@qantara-am.com or

by mail to QANTARA Asset Management 44 bis rue pasquier 75 008 Paris

This document is intended solely for the persons to whom it was originally addressed and may not be used for any purpose other than that for which it was intended. It may not

be reproduced or transmitted, in whole or in part, without the prior written consent of QAM, which shall not be held liable for any use that may be made of the document by a

third party. The names, logos or slogans identifying QAM's products or services are the exclusive property of QAM and may not be used in any manner whatsoever without the

prior written consent of QAM.